About Target Income Portfolios

Lower fees, reduced risks and better outcomes.

Risk-based

Glidepaths

Fiduciary to glidepath creation and asset allocation

Largest provider of multiple-glidepath target date funds in the industry

Fastest growing target date fund manager with over $83 billion in AUM

Multiple glidepaths allow participants to customize the amount of equity risk they want to assume as retirement nears

Platform Provider

Custom portfolios built on TIAA’s managed account platform

Replaces bond allocations with guaranteed monthly returns from TIAA’s Traditional Annuity

Long-term investors are eligible to receive higher annuity payout rates

Incorporates automatic portfolio adjustments to avoid duplicating legacy annuity balances

Fiduciary to Underlying Fund Selection

|

|

|

|

|

Discover Your PATH to Retirement

The Discover Your PATH tool is designed to measure your need to take investment risk, based on your projected savings at retirement. Risk tolerance is a combination of both desire and need to take investment risk. Many investors have an intuitive understanding of their desire to take investment risk, but may need a helping hand to better understand their need to take investment risk. Generally, investors who are on track for retirement can afford to de-risk and invest more conservatively to emphasize stability of their hard earned assets. On the other hand, investors who are behind saving for retirement may need to invest more aggressively to emphasize growth, and/or begin saving more in order to make up for a shortfall of current savings.

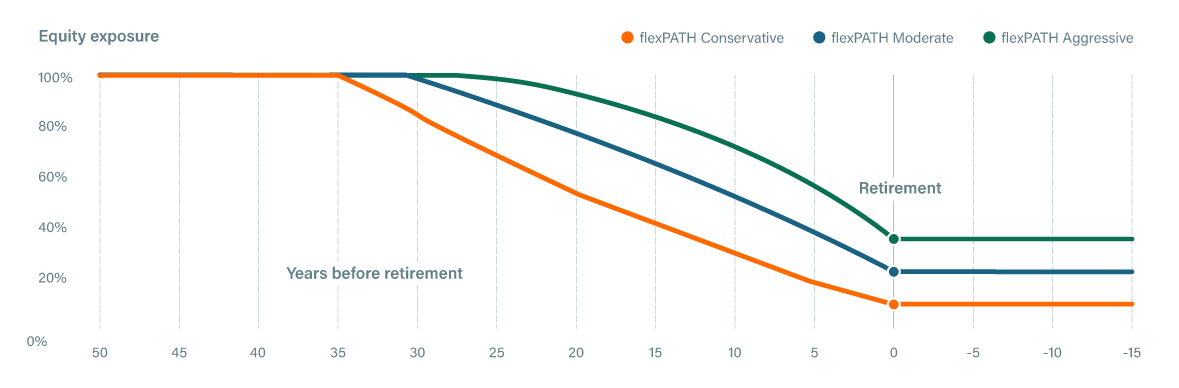

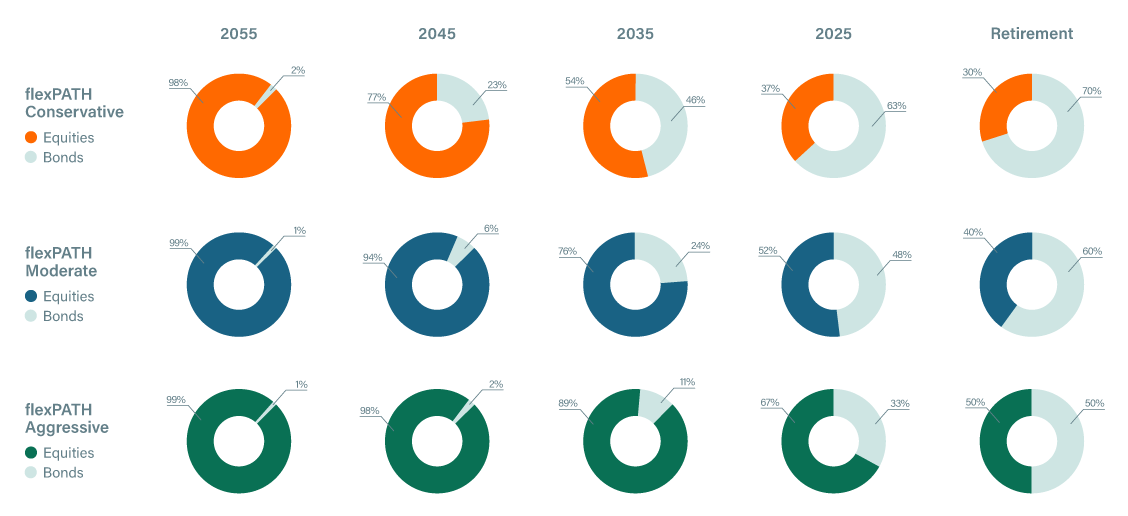

Target Income Portfolios Glidepaths

The glidepath needs of all plan participants are addressed with the availability of a conservative, moderate and aggressive glidepath.

After selecting the closest year (2025, 2035, 2045, 2055, or 2065) in which you expect to retire, consider both your comfort with risk as well as the amount of risk needed to accomplish your retirement goals when selecting the most appropriate retirement PATH.

Conservative PATH

Risk is limited because enough has been or is being saved to live on during retirement. The goal is to achieve a more consistent retirement income pattern throughout retirement.

Conservative PATH characteristics:

- Retirement savings rate more than 12%

- High account balance

- Emphasis on stability and capital preservation in retirement

-min.png?width=800&height=450&name=Moderate%20(1)-min.png)

Moderate PATH

Risk can be moderate because current savings will accomplish most retirement goals. Additional risk is necessary to fully achieve all retirement goals, balanced with a more consistent income pattern.

Moderate PATH characteristics:

- Retirement savings rate between 6-12%

- Average account balance

- Balance stability and long-term return in retirement

Aggressive PATH

Risk is greater because current savings alone will not be enough to reach most retirement goals. The goal is to generate greater expected return through riskier investments in order to supply adequate income at and throughout retirement.

Aggressive PATH characteristics:

- Retirement savings rate less than 6%

- Low account balance

- Emphasis on long-term return in retirement