About MyCompass Index Funds

MyCompass Index is a target date solution offering a professionally managed, diversified, and personalized PATH to retirement.

MyCompass Index Funds

How Target Date Funds Work

Target date funds are professionally managed, diversified investment portfolios.

Each portfolio consists of a mix of investments appropriate to its target date so investing in a single portfolio can provide a robust diversification and asset allocation.

MyCompass Index is a target date fund solution offering professional management, diversification, and a simple way to invest for retirement.

In addition, several key features distinguish MyCompass Index from a typical TDF, including flexibility for your own personal risk tolerance, open-architecture manager selection, and low-cost management.

Risk-based

Glidepaths

Fiduciary to glidepath creation and asset allocation

Largest asset manager in the world with over $10 trillion in AUM

Works with 60% of Fortune 100 firms

Inventor of the target date fund (1993)

Multiple glidepaths allow participants to easily choose their own path to retirement based on their personal needs and preferences

Independent Underlying

Fund Selection

Fiduciary to underlying investment selection and monitoring

Largest provider of multiple-glidepath target date funds in the industry

Fastest growing target date fund manager with over $36 billion in AUM

Robust investment search processQuantitative research driven by the Scorecard SystemTM, used by 3,000+ retirement financial professionals with over $800 billion in assets

Qualitative research driven by committee of 9 CFA charterholders

Exclusive to Voya Retirement Plans

Index management by BlackRock, the largest index manager in the world and inventor of the index fund (1971)

Incorporates stable value with the goal of improving portfolio stability and risk-adjusted returns

Low cost

Discover Your PATH to Retirement

The Discover Your PATH tool is designed to measure your need to take investment risk, based on your projected savings at retirement. Risk tolerance is a combination of both desire and need to take investment risk. Many investors have an intuitive understanding of their desire to take investment risk, but may need a helping hand to better understand their need to take investment risk. Generally, investors who are on track for retirement can afford to de-risk and invest more conservatively to emphasize stability of their hard earned assets. On the other hand, investors who are behind saving for retirement may need to invest more aggressively to emphasize growth, and/or begin saving more in order to make up for a shortfall of current savings.

MyCompass Index Glidepaths

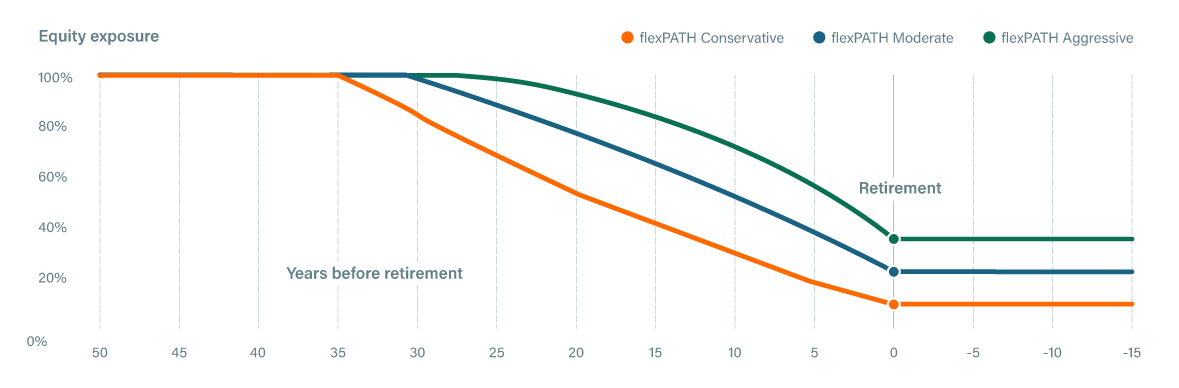

The glidepath needs of all plan participants are addressed with the availability of a conservative, moderate and aggressive glidepath.

After selecting the closest year (2025, 2035, 2045, 2055, or 2065) in which you expect to retire, consider both your comfort with risk as well as the amount of risk needed to accomplish your retirement goals when selecting the most appropriate retirement PATH.

Conservative PATH

Risk is limited because enough has been or is being saved to live on during retirement. The goal is to achieve a more consistent retirement income pattern throughout retirement.

Conservative PATH characteristics:

- Retirement savings rate more than 12%

- High account balance

- Emphasis on stability and capital preservation in retirement

-min.png?width=800&height=450&name=Moderate%20(1)-min.png)

Moderate PATH

Risk can be moderate because current savings will accomplish most retirement goals. Additional risk is necessary to fully achieve all retirement goals, balanced with a more consistent income pattern.

Moderate PATH characteristics:

- Retirement savings rate between 6-12%

- Average account balance

- Balance stability and long-term return in retirement

Aggressive PATH

Risk is greater because current savings alone will not be enough to reach most retirement goals. The goal is to generate greater expected return through riskier investments in order to supply adequate income at and throughout retirement.

Aggressive PATH characteristics:

- Retirement savings rate less than 6%

- Low account balance

- Emphasis on long-term return in retirement

Select Your Target Date Fund to View Asset Allocation

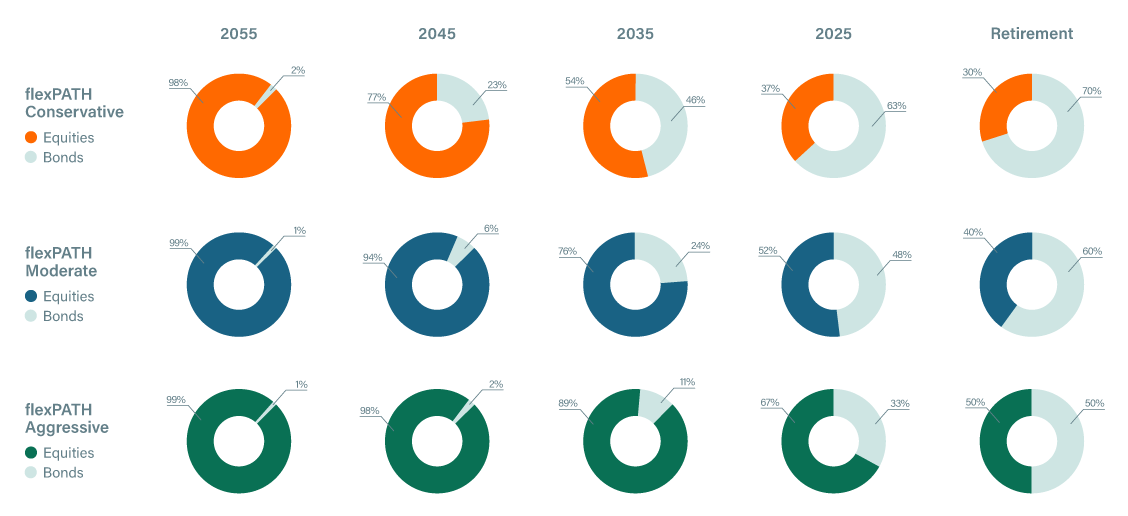

Stocks

This mix of global stocks seeks to provide growth for the flexPATH strategies. This allocation may also include exposure to commodities and real estate investment trusts, which seek to add diversification to the flexPATH strategies.

Bonds

Made up of exposure to U.S. inflation-protected bonds and other fixed income securities, these investments look to provide the strategies with reduced exposure to market risk and volatility